AI-optimized customer lifetime value prediction helps businesses unlock the real profit potential in every customer relationship. By combining the power of data and machine learning, you can forecast the long-term value of your customers, guiding better marketing and retention decisions. This service is in high demand as companies compete to keep loyal buyers and get the most from each interaction.

With smart prediction models, brands can target their most valuable customers and automate their offers to boost revenue. In this guide, you’ll find practical steps to set up your own profitable AI-optimized CLV system, draw higher-paying clients, and deliver results companies will pay for. Get ready to learn how this skill can drive new income streams and give you an edge in the market.

Understanding Customer Lifetime Value (CLV) and Its Importance

Photo by Pixabay

Photo by Pixabay

Customer Lifetime Value (CLV) is a simple yet powerful concept that shows how much value your business can expect from a single customer over their entire relationship with you. If you want to run a profitable business, knowing your CLV is a must. This number can reveal which customers have the most potential and where your time, effort and investment should go.

It’s more than a financial metric. CLV brings together insights from marketing, sales and customer service into one measurable outcome. Understanding CLV enables smart business choices, helps target profitable clients, and grows customer loyalty. Let’s break down why CLV matters so much.

What Is Customer Lifetime Value?

CLV is the total revenue a business expects from a single customer from their first purchase to their last. It considers not just what a person spends today, but also what they might spend if they return or recommend others. Think of CLV as looking at the entire story instead of just the first chapter.

Key parts of CLV include:

- Customer Spending: How much, on average, does a typical customer buy from you?

- Purchase Frequency: How often do they come back?

- Customer Lifespan: How long do they stay loyal to your brand?

According to Netsuite’s CLV guide, understanding this number leads to better forecasting, efficient budgeting, and stronger long-term planning.

How CLV Guides Smart Business Decisions

Knowing your customers’ full value changes how you run your business. With CLV data, you can:

- Focus your budget on customers who bring in more profit.

- Tailor your offers and loyalty programs to keep high-value clients.

- Avoid overspending trying to win back low-value buyers.

- Predict future sales and adjust your strategies with confidence.

As outlined in Wharton’s analysis, businesses that monitor and optimize CLV usually outperform their competitors. The reason is simple: they invest in what truly grows their bottom line.

Why CLV Matters for Profitability and Growth

Growing profit isn’t only about finding new buyers. It’s about increasing the value of the customers you already have. CLV puts a spotlight on quality over quantity—highlighting the importance of nurturing relationships and retaining your best clients.

Here’s what makes CLV so valuable for sustainable growth:

- Long-Term Focus: You can plan for the future, not just react to sales spikes.

- Better Decision-Making: With a clear picture of actual customer worth, you avoid wasted spending.

- Higher ROI: Marketing and service investments are directed at segments with the most growth potential.

For a deeper dive on how CLV links to business profitability and planning, check out Qualtrics’ CLV explanation.

Using CLV in an AI-Driven System

Integrating AI with CLV prediction takes this process from good to outstanding. AI finds patterns faster, personalizes outreach and predicts when a customer may churn or buy again. Brands can segment audiences, prioritize action, and deliver targeted messages that resonate.

If you’re interested in putting AI to work for your client projects or scaling your own CLV prediction service, you can learn more in our step-by-step guide to earning with AI-assisted book summarization. The same principles of data-driven growth can apply to CLV prediction and beyond.

Leveraging AI for Accurate CLV Prediction

AI and machine learning have completely changed the way businesses figure out who their most valuable customers are. Instead of relying on guesswork or basic formulas, companies can now use huge amounts of customer data to predict future spending, churn risk, and more with surprising accuracy. AI models spot trends and patterns that humans just can’t see, giving you a real edge when planning marketing, retention efforts, and support teams. Let’s get into the essential data you’ll need and how to choose the right tech to power your AI-optimized CLV service.

Key Data Inputs Required for AI-Driven CLV Modeling

To make AI-driven CLV prediction work, you need more than just a few spreadsheets with purchase totals. The rich, detailed data you feed into your models has a major impact on prediction accuracy. The good news? Most businesses already collect this information, but putting it together for AI use is the secret sauce.

Here’s what you should gather and connect:

- Transaction History

Think of this as the backbone of CLV prediction. Gather every purchase, order value, items bought, and purchase dates for each customer. This helps track spending trends and recency, which are crucial for forecasting. - Engagement Metrics

Who opens your emails, clicks on links, or spends extra time browsing your app or site? Engagement stats reveal who’s interested and likely to stick around. Strong engagement often predicts higher lifetime value and opens more doors for upselling or retention campaigns. - Demographics

Factors like age, gender, location, and occupation can shape buying behavior and preferences. AI models use this info alongside other behavior metrics to create a fuller, more predictive picture. - Support Interactions

Records of customer support chats, calls, or emails can highlight satisfaction or churn risk. Happy customers tend to spend more over their lifetime. - Product Returns and Complaints

Negative touchpoints aren’t just complaints, they’re valuable warning signs. Tracking them helps AI spot churn risks and segment unhappy customers for service recovery.

Connecting all these data types, AI models can identify subtle signals—like a spike in returns or a change in buying frequency—that flag a shift in customer value. Not sure which algorithms are best for this work? Explore machine learning frameworks that are proven to boost CLV accuracy, as noted in this review of top CLV prediction models.

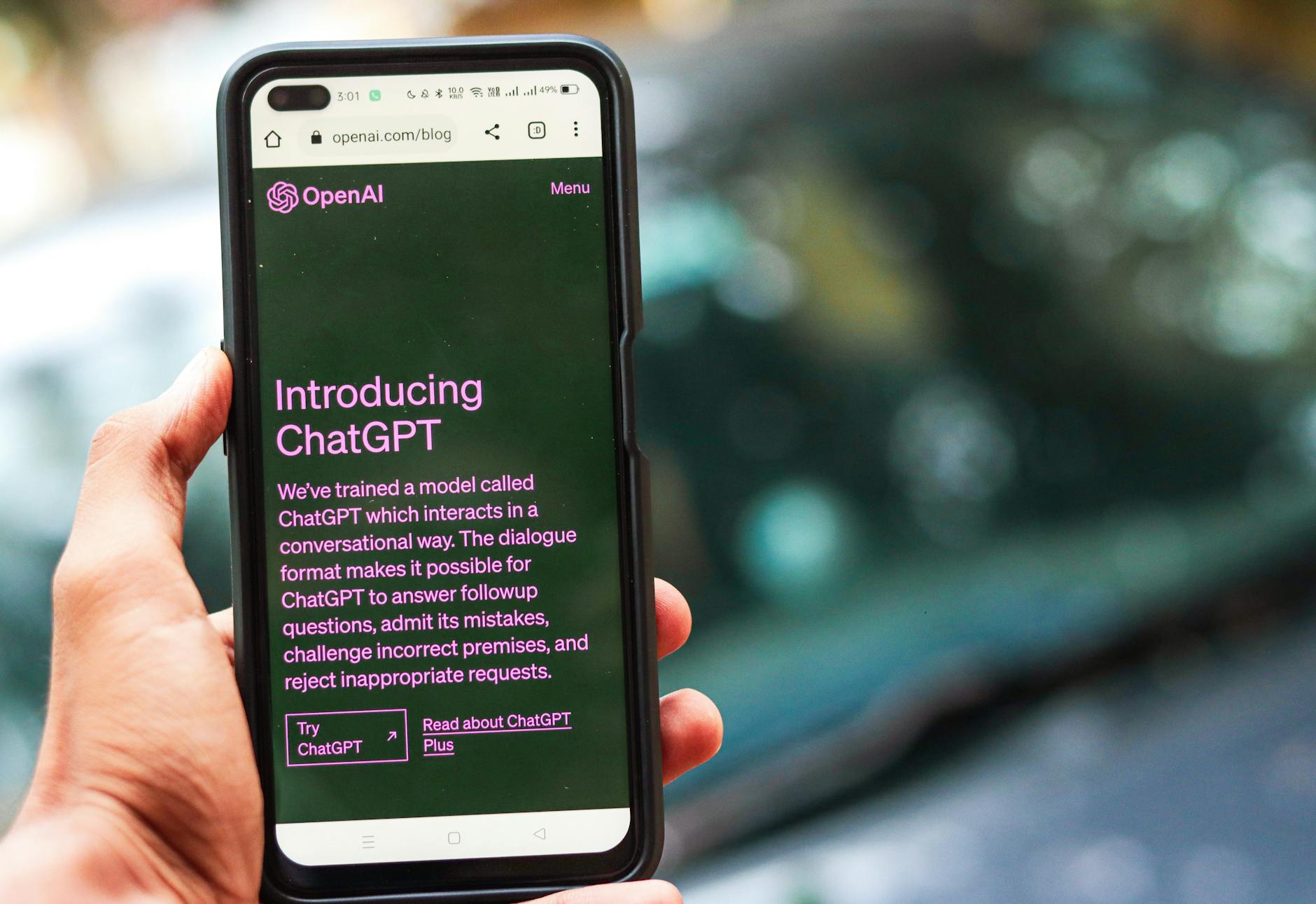

Selecting the Right AI Tools and Platforms for CLV

AI tools can be simple or stunningly sophisticated. The best fit depends on your budget, data volume, and the skills you (or your client) have available. Here’s a side-by-side glance at popular AI platforms that support customer lifetime value prediction:

Photo by Google DeepMind

Photo by Google DeepMind

- Google Cloud AutoML: Allows users without deep coding knowledge to train custom models for CLV and more. It’s a cloud service, so you can scale up easily. Great for those with Google ecosystem data.

- Salesforce Einstein: Baked right into the world’s most popular CRM, Einstein’s AI features pinpoint high-value leads with minimal setup. Designed for sales and marketing teams who want out-of-the-box insights.

- Microsoft Azure AI: Offers flexibility for complex setups, custom model training, and deep analysis. Perfect for bigger ops and those already invested in Microsoft tools.

- Custom Machine Learning Solutions: For unique needs or huge data sets, some choose to work with Python-based frameworks like scikit-learn or TensorFlow. These open-source tools provide maximum control but require in-house expertise.

- All-in-One AI Platforms: There are now specialized tools designed just for CLV and customer analytics that offer plug-and-play features for segmentation, prediction, and campaign automation. Check reviews of features and benefits in this list of top AI tools to enhance customer lifetime value.

When picking your solution, factor in costs (subscription vs. usage-based pricing), how well the tool connects to your existing systems (CRM, e-commerce, marketing platforms), and the support you’ll need for setup and scaling. Want a closer look at how marketers use these tools in practice? This discussion on AI platforms for CLV prediction highlights real-world success stories and tips.

For service providers aiming to turn CLV prediction into a steady revenue stream, understanding the balance between tech investment and hands-off solutions can put you ahead. You’ll be able to deliver tailored results to clients, whether they have a starter Shopify store or a global customer base.

If you’re interested in another way to profit from AI-powered services, look into our guide to earning with AI-assisted summarization that covers scalable systems and client management—skills that transfer perfectly to CLV optimization.

Building and Running an AI-Optimized CLV Prediction Service

Turning AI-optimized CLV prediction into a steady income stream takes more than just great models. You need reliable tech, organized client workflows, and smart pricing if you want to build a sustainable business. This section breaks down the practical steps to launch and scale your CLV service, making sure your operations stay smooth and your clients see real value.

Setting Up Your Technical and Data Infrastructure

Photo by Sanket Mishra

Photo by Sanket Mishra

A rock-solid technical setup is at the core of every AI service. Streamline your data, automate your reporting, and keep everything connected for maximum efficiency.

- Cloud Solutions: Use platforms like Google Cloud, AWS, or Azure for secure storage and easy scaling. Cloud servers let you process and update large datasets without heavy upfront costs.

- Data Pipelines: Build automated data flows to pull customer, sales, and engagement data from sources like e-commerce stores, CRMs, or third-party apps. Tools like Apache Airflow or managed data integration connectors speed up this process.

- Automated Reporting: Set up dashboards using Power BI, Tableau, or Google Data Studio so clients get regular updates on CLV trends. This keeps them engaged and reinforces your value.

- Integrate with Existing Platforms: Connect your AI models to popular CRM (like Salesforce or HubSpot) or marketing tools. This allows businesses to act on your CLV insights right inside their usual tools, boosting adoption and satisfaction.

For more details on workflow and deployment, check out this practical step-by-step guide to using AI for CLV optimization. Strong tech foundations make onboarding clients and delivering results much easier.

Best Practices for Prospecting and Winning High-Value Clients

High-paying clients keep your service profitable. Focus on industries where CLV insights drive real business results:

- E-commerce: Online stores want to pinpoint their biggest spenders and optimize repeat purchases.

- SaaS: Subscription services need CLV models to reduce churn and upsell features.

- Financial Services: Banks, insurance firms, and fintech companies want smarter retention and risk management based on lifetime value.

Identify your best-fit prospects by looking for brands:

- With growing customer bases

- That invest heavily in marketing automation

- Open to outsourcing analytics for better ROI

When you approach a new client, keep your pitch clear and outcome-focused:

- Highlight ROI: Share how higher CLV can boost their top and bottom line.

- Use Case Studies: Show before-and-after snapshots to prove your results. Real-world numbers grab attention and build trust.

- Offer Tailored Solutions: Speak their language. For a fashion e-commerce brand, talk about increasing repeat purchase rates, not just data science.

Relevant case studies and value-driven presentations will get you noticed. For more on building a winning service, see this in-depth AI customer lifetime value prediction guide for business owners.

Pricing Your AI-Optimized CLV Prediction Service for Maximum Profitability

How you price your service shapes your monthly income. Match your structure to client needs and your business goals with these common options:

- Value-Based Pricing: Charge a percentage of the revenue uplift or savings you provide. If your insights drive a 10% boost in sales, you take a small cut.

- Retainer Model: Bill a flat monthly fee for ongoing predictions, monitoring, and support. This creates stable recurring income and keeps you close to your clients as needs change.

- Tiered Offerings: Offer basic reports for small brands, enhanced automation for mid-size teams, and enterprise packages with API access and custom dashboards for larger clients.

For example:

- Small e-commerce: $500/month for automated dashboards and monthly updates.

- Growth-stage SaaS: $1,500/month for custom modeling, segmentation, and integration help.

- Enterprise: $3,000+/month for end-to-end automation, on-call analytics, and direct CRM integration.

Mix and match these models as you grow. Adjust your tiers as you deliver more value or automate more of your workflow. If you’re interested in scaling AI-based services with workflows that minimize hands-on management, find inspiration in our AI chapter summarization earnings playbook.

With strong technical systems, targeted prospecting, and smart pricing, you can position your CLV prediction service as an ongoing profit center, not just a side project.

Maximizing Revenue and Client Retention with Actionable CLV Insights

To run a profitable AI-optimized CLV service, you need to do more than build great models. You need to take CLV insights and turn them into real changes that drive revenue and keep clients loyal. By connecting data to action, you can boost not only your client’s marketing results but also your own recurring income. This section shows practical ways to use CLV data in campaigns, plus how to keep clients engaged and coming back for more.

Integrating CLV Insights into Client Marketing Campaigns

Photo by Kaboompics.com

Photo by Kaboompics.com

Turning customer lifetime value data into higher sales and loyalty is what sets you apart. Here’s how to translate your predictions into clear marketing moves:

- Segment Audiences by Value

Split customers into groups based on predicted lifetime value. Top-tier customers get premium offers, early access, or higher support. Lower-tier groups can get re-engagement campaigns or lower-cost perks to boost spending. - Personalize Offers for Each Segment

Use CLV segments to guide what deals you send. High-value customers might appreciate VIP sales or exclusive bundles, while newer or mid-value buyers may need simple first-purchase discounts. When clients see more revenue from targeted offers, they keep coming back for your data. - Optimize Ad Spend

Focus marketing budgets on high-value audiences with a strong chance of repeat purchase. CLV modeling reduces wasted spend on shoppers that won’t stick with the brand. Tailored spend means better ROI and happier clients. - Smart Upsell and Cross-Sell Recommendations

Align product suggestions with customers who show high long-term value. Predictive CLV lets you time upsells right, which grows average order value and cements loyalty. - Churn Prevention Campaigns

Spot at-risk customers early and trigger personalized win-back campaigns. AI-driven CLV can highlight risky segments fast, letting you automate retention messages or special offers just for them.

When you deliver these actions, you’re not just running numbers—you’re making clients more money each quarter. This kind of hands-on insight also opens up recurring revenue opportunities, from monthly segmentation refreshes to seasonal offer planning.

For more ways to systematize and automate your data approach for multiple clients, review these workflow tips for AI-powered service providers.

Developing Long-Term Relationships through Value-Added Reporting

Offering great predictions is only step one. To build long-term, high-value client relationships, your reporting needs to turn raw data into clear and valuable stories. When your clients easily see the impact of your work, trust and commitment grow.

Practical ideas to boost client retention through better reporting include:

- User-Friendly Dashboards

Build dashboards that share CLV metrics, recent campaign gains, and upcoming growth opportunities. Use plain-language labels, bold color highlights, and simple charts. This keeps things clear for both data experts and first-time business owners. - ROI-Focused Reporting

Show the real impact of your service by tracking uplift in revenue, retention rates, or upsell numbers linked to your CLV recommendations. Make wins easy to spot, and always relate data to concrete business outcomes. - Regular Strategy Updates

Share short, punchy monthly updates or strategy calls. Discuss trends you see in models, highlight what worked last month, and share three recommended actions for the quarter ahead. This rhythm keeps clients engaged and deepens trust. - Proactive Recommendations

Go beyond reporting by offering new ideas for upsells, churn prevention, or fresh campaign tests based on your data analysis. Clients want a partner, not just data—they want to know you’re working for their next big win.

A focus on value-added reporting isn’t just for client peace of mind. It opens the door for new upsell opportunities like custom analytics add-ons, quarterly deep-dive reviews, or expanded segments as your client’s business grows.

For a detailed look at scaling client-facing AI services, including how to structure ongoing reports and maximize results for both sides, check out this advanced client acquisition and retention blueprint.

By pairing CLV-driven actions with clear, ROI-focused communication, you multiply the lifetime value of your own client base—making your income as predictable as the models you build for customers.

Real-World Success Stories and Lessons Learned

AI-driven customer lifetime value prediction is not just theory—plenty of businesses are already seeing major returns. Let’s look at real-world stories that show what’s actually possible. These examples cover both e-commerce and SaaS, highlighting how the right AI strategy leads to higher revenue, smarter marketing, and steady client gains.

E-Commerce Boost: Targeted Promotions Increase Repeat Purchases

Photo by Antoni Shkraba Studio

Photo by Antoni Shkraba Studio

A mid-sized online retailer selling beauty products implemented AI-powered CLV predictions to overhaul their promotions strategy. Using machine learning, they identified which customers showed the strongest long-term value and which were only likely to make a one-time purchase.

Instead of sending blanket discounts, the retailer personalized offers for three segments:

- High-value customers received exclusive previews and loyalty perks

- First-time buyers got single-use discounts to prompt their second order

- At-risk customers were targeted with gentle reminders and bundled offers

The results? The company increased the rate of repeat purchases by 18%, and profits per customer jumped significantly within three months. The firm credited this success to using CLV scores for campaign targeting and ad spend adjustment, cutting wasted marketing costs. For details on how AI-powered CLV reshaped e-commerce profits, check this real-world case study on e-commerce transformation.

SaaS Case: Churn Drops and Upsells Rise with Predictive Modeling

A fast-growth SaaS startup wanted to fight churn and uncover new sales opportunities. By deploying AI CLV models, their team bucketed users by not just how much they spent, but how likely they were to renew or buy add-ons.

- At-risk accounts received personalized check-ins and free consultations

- Power users (those likely to expand their subscriptions) got early-bird pricing on new features

- Newly onboarded users received onboarding nudges, but no unnecessary discounts

The company saw a 12% reduction in churn over six months and a 9% rise in bundle upgrades. According to their marketing director, “AI predictions gave us the confidence to nudge customers at the best moment, rather than waste effort on every account.” For a deeper look at why SaaS firms are doubling down on this approach, explore the industry perspective in Why We’re Focusing On AI-Powered Customer Success for SaaS.

Retailers Tap AI for Seasonal Revenue Spikes

National retailers often face unpredictable seasonal swings, so one major chain turned to AI-driven CLV models to stabilize sales year-round. By mapping each customer’s historic spend and engagement, marketing could target high-value buyers with exclusive offers before peak sale events.

- VIP holiday bundles were sent to top spenders

- Regular customers got early-bird notifications

- Buyers with declining activity received limited-time comeback incentives

This precise targeting cut down on ad waste and drove a 14% spike in seasonal revenue compared to the previous year. Retail leadership attributed gains not only to bigger average checkouts, but also to a measurable drop in lapsed customers. Dive into more stories in this industry comparative analysis.

Lessons from CLV Service Providers: Mistakes Turned Into Growth

No process is perfect from the start. Some agencies trying to sell CLV prediction made these early mistakes:

- Overpromising Results: Clients were told to expect overnight wins. Reality often required 60-90 days for usable gains.

- Ignoring Small Data Sources: Only using purchase history, skipping support chats or feedback, hurt prediction reliability.

- Complicated Reporting: Reports needed to be clear, showing directly how actions impacted revenue or retention.

Successful providers course-corrected quickly. They simplified their onboarding, educated clients about timelines, and boosted transparency around the actions required to see results. Learning from their stumbles, these service owners built deeper relationships with clients and drove higher upsell rates for custom analytics.

For service models that scale well, including how to handle client feedback, see this blueprint for recurring revenue with AI-powered services.

What the Data Shows: Consistent Uplift across Sectors

Industry research confirms what these mini case studies reveal: businesses adopting AI-powered CLV prediction routinely see:

- Higher marketing ROI (less wasted spend, more high-value conversions)

- Increased upsell rates and customer loyalty

- Better alignment between marketing, support, and sales

For a broader summary of findings from multiple case studies, check this review of AI-powered predictive CLV impacts.

By tapping into proven strategies and learning from early mistakes, you can position your service as a true profit-driver for clients. Each win brings you closer to a stable, recurring income stream and positions you at the front of a high-demand field.

Conclusion

AI-optimized CLV prediction puts you in the driver’s seat for real business growth. By taking action on these insights, you help your clients keep their best customers, boost sales, and cut wasted marketing spend. The strongest results come when you mix accurate models with practical strategies and clear communication.

If you’re ready to launch your own AI-powered service, now’s the best time to start. Focus on building a strong workflow from data collection to client reporting. Look for high-value opportunities, set up pricing that rewards your results, and always show clients the gains you deliver.

For more step-by-step guidance as you build out your own AI-driven service business and want additional tips for scaling up, review this guide on turning AI skills into monthly income.

Thanks for reading—your next win could be just one model away. If you’ve learned something helpful here, share your own experiences or ideas. Your story could help others take their first step, too.